By Dr Olive McCarthy and Allen Meagher (pictured below)

The European Central Bank’s Cash Strategy spells out eight functions and benefits of cash and it commits to protecting access to cash services for all. However, many large organisations are heading in the opposite direction.

The European Central Bank’s Cash Strategy spells out eight functions and benefits of cash and it commits to protecting access to cash services for all. However, many large organisations are heading in the opposite direction.

Almost all of the ECB’s Cash Strategy functions relate to supporting the financial inclusion and protection of consumers. It recognises that cash doesn’t involve a third party – you simply hand it over – and cash ensures privacy in financial transactions.

Cash is fast and secure and cannot be refused except by prior agreement on the means of payment. Strong emphasis is given in its strategy to the inclusive nature of cash, particularly for those who lack or have limited access to digital payments systems. It specifically states that cash is “essential for the inclusion of socially vulnerable citizens, such as the elderly or lower-income groups”.

While that is the ECB’s strategic outlook, big companies are heading in the other direction. At least one major not-for-profit organisation has partly joined in.

Ryanair refuses to take cash and it’s hard to argue with them at 8,000 feet. The company behind Electric Picnic has gone the same way and it warned vendors this year not to accept cash payments.

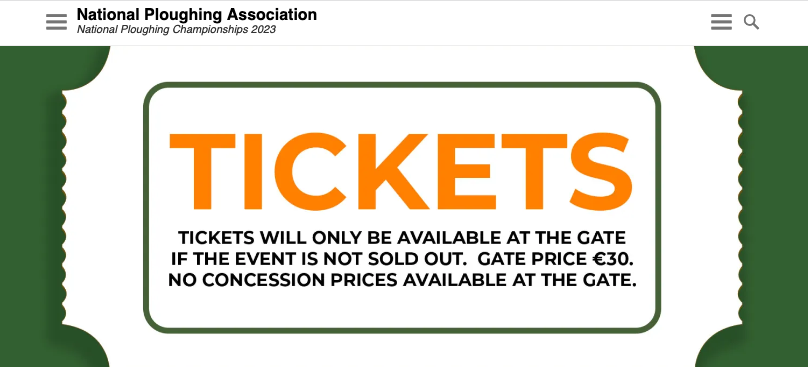

Even the National Ploughing Championship is making cash-paying customers feel like second class citizens. This year for the first time, it charged attendees €35 on the gate – a punishing €10 more than online.

• The National Ploughing Association charged €10 extra for each cash-paying OAP to enter this year. Online tickets cost only €20. Source: npa.ie

Applus, the company with the contract for National Car Testing, announced plans during the summer to go cashless. Despite the Dáil being in recess, it was forced to relent by angry politicians. Similarly, a year earlier, AIB was forced to backtrack during the summer when it announced a plan to close over-the-counter cash services in 70 branches. After an intense public backlash, the bank “decided not to proceed”.

AIB knows the social value of its service. Research commissioned by Ireland’s Department of Finance in 2022 shows that the main reason people visit a bank branch in Ireland is to lodge or withdraw cash. People on lower incomes, people aged over 65, and people in rural communities were generally found to be more reliant on cash payments and less likely to use online banking.

There are also moves away from cash beyond the private sector. The GAA, in announcing local club fixtures, now often tells supporters it will only accept digital payments and tickets must be purchased in advance. In practice, it may allow in OAPs who pay cash, but cash is no longer king, and this exception to the rule is not publicised, certainly not in Co Limerick. For inter-county matches, you still have the fair choice of buying tickets online or in local shops.

Age Action Ireland reports that 65% of people over the age of 65 experience digital exclusion, impacting their ability to access online or contactless financial services. For this cohort, cash transactions remain essential to everyday life. This is also true for those on low incomes.

In 2020, 30% of Irish social welfare recipients were paid in cash. Research by UCC researchers for by Clúid Housing and the Housing Finance Agency showed that people on lower income often manage their finances best – both spending and saving – using cash, because it helps them to feel more in control or because they have had negative experiences with missed direct debits and bank charges.

Money management advisors, such as the State’s Money Advice and Budgeting Service (MABS), advise some consumers to use cash to manage certain expenditure as it is more tangible, making it easier to keep track.

Although the use in Ireland of non-cash payments increased by 52% in 2020, cash remains of significant importance to many.

In rhe UK, a 2019 report asserted that 17% of the UK population would struggle to cope in a cashless society and would be ‘left behind’.

In Sweden and Norway, where there has been a dash from cash, regulators now oblige banks to ensure the availability of cash services because people in rural areas and older consumers say they would find it difficult to cope without cash.

A Retail Banking Review currently underway by the Department of Finance recognises that a fully cashless society is not an appropriate objective and acknowledges cash as facilitating financial inclusion. Ireland’s Financial Inclusion Strategy, which is now 11 years old (and not available online) focused on the provision of a standard banking account to address financial exclusion. This was superseded by the EU Payment Accounts Directive in 2016 making basic bank accounts available to all.

It is essential that a revised strategy emerges to protect and promote access to financial services. It should empower consumers by building financial capability and well-being for all. This must include access to cash and cash services.

New caps on moneylending could end exorbitant interest rates