At the launch of its Budget 2024 briefing today, Social Justice Ireland called for a monthly increase of €50 in child benefit payments for all.

The independent think tank pointed out that the payment is “a key route out of child poverty, and should be one of the key elements of proposed reforms”.

Other suggestions include a new €20 weekly ‘cost of disability’ payment, and the introduction of an aviation tax at €5 to €30 per passenger.

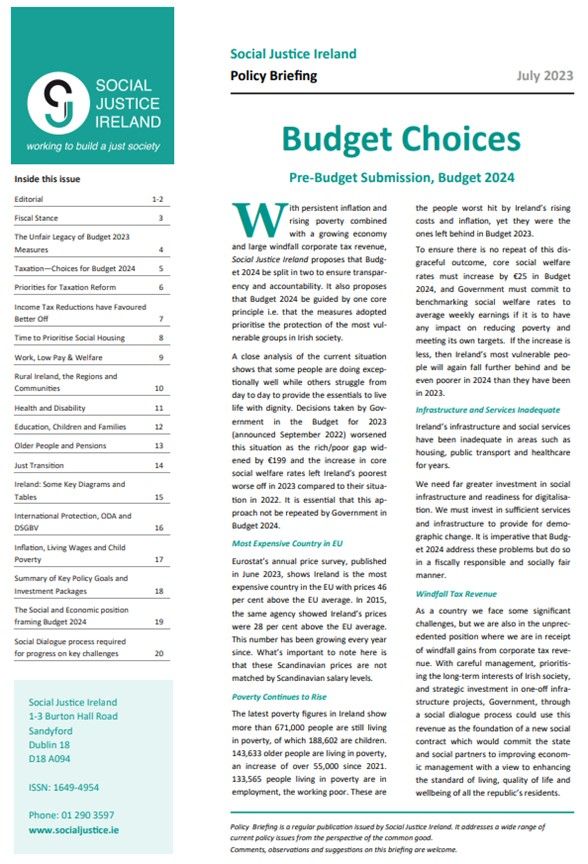

Overall, SJI advised that “Budget 2024 should be guided by one core principle, that the measures adopted prioritise the protection of the most vulnerable groups in our society”.

The organisation’s co-founder and CEO Fr Sean Healy remarked that there should be “no repeat of the disgraceful outcome we got in Budget 2023”.

The ‘Budget Choices 2024’ briefing also suggested the introduction of “a new social contract, which would commit the state and social partners to improving economic management with a view to enhancing the standard of living, quality of life and wellbeing of all the republic’s residents”.

The organisation said that the social contract should have five core goals: to deliver a vibrant economy; decent services and infrastructure; just taxation; good governance; and sustainability.

“Crucially, however, these five outcomes must be addressed simultaneously. It is not sufficient to prioritise economic development with the argument that this will produce the resources to achieve the other four outcomes,” SJI warned.

“All five Pillars of Social Dialogue (employers, trade unions, farmers, community/voluntary and environmental) should be involved in its development and implementation.”

SJI added that if the Government is serious about meeting its own poverty targets, it must increase core social welfare rates by a minimum of €25 in Budget 2024, adding that income adequacy “cannot be addressed by one-off measures”.

The Budget Choices 2024 document also pointed out: “The budget arises in the context of large windfall corporation tax revenues (€5 billion) flowing to the exchequer from a very small number of multi-national companies. Budget 2024 needs to articulate a clear strategy for the management of these funds framed in the context of the long-term interests of Irish society.”

With that in mind, SJI has proposed that Budget 2024 should be split in two, with the once-off windfall tax gains to be invested only in one-off and infrastructure projects, and accounted for separately.

The normal budget would then be presented using the regular budget process.

Summary of Key Packages

Windfall ‐ €5 billion:

– Infrastructure investment in Sláintecare – €600m

– Increase social housing construction – €1.4bn

– Invest in off‐shore wind energy infrastructure – €1bn

– ODA (Overseas Development Aid), Climate Finance and Loss and Damage – €1bn

– World Hunger Fund – €1bn

Regular Budget

Housing: €170.3m net package including an increase in stamp duty for transfers of property exceeding €1m, an end to the Help to Buy Scheme and investment in homelessness prevention.

Just Transition: €339.6m net package including investment in renewable energy, biodiversity, just transition and the circular economy (including the introduction of a pilot circular economy town), investment in climate research. The introduction of an aviation tax per passenger of €5 to €30 on commercial flights to yield €215m.

Healthcare, carers and disability: €942.3m investment prioritising social and community care, disability, and mental health. Including a new cost of disability payment of €20 per week at a cost of €228m.

Children and Families: €1,147.7m investment in an increase to child benefit, early childhood care and education, and child protection.

Rural, Regional and Community Development: €667.9m investment prioritising the regional development and transition, rural transport, integration, and community schemes.

Education: €402.4m investment in areas such as reducing class sizes, adult literacy, DEIS, skills development, community education, digital education and higher education.

Pensions and Older People: €1,143.7m prioritising a universal pension, investment in social care and Home Care Packages and increased funding for nursing homes.

Taxation Reform:

Minimum Effective Rate of Corporation Tax to yield €1bn

Increases to capital taxes to yield €176m

Introducing a Financial Transactions Tax to yield €350m

Budget Choices 2024 is available to download here.

Social Justice Ireland’s work is partly supported by the Department of Rural and Community Development via the Scheme to Support National Organisations.